Signals From VARA Pro Q2/2024

This review outlines how more than 100 European blue-chip companies performed during the second quarter of 2024. We analyzed six key areas:

Estimates versus actuals for both top line and bottom line figures (as an indicator of surprises).

Growth expectations for top line and bottom line (12 month forecast vs. trailing twelve months, TTM).

Lastly, we reviewed the TTM index and used this data to update our Estimates Compass.

It appears that margins have peaked, and near-term performance will depend heavily on top-line growth (sales growth). Sales growth expectations have declined significantly, now sitting at around 5%. Therefore, the potential for disappointment in top line performance looks limited. Meanwhile, the current situation appears to be stabilizing.

Top Line:

As margin increase looks to have peaked, the near term performance will depend on top line performance. 53% of companies beat the expectations. This situation continues to improve, but still not in upper third.

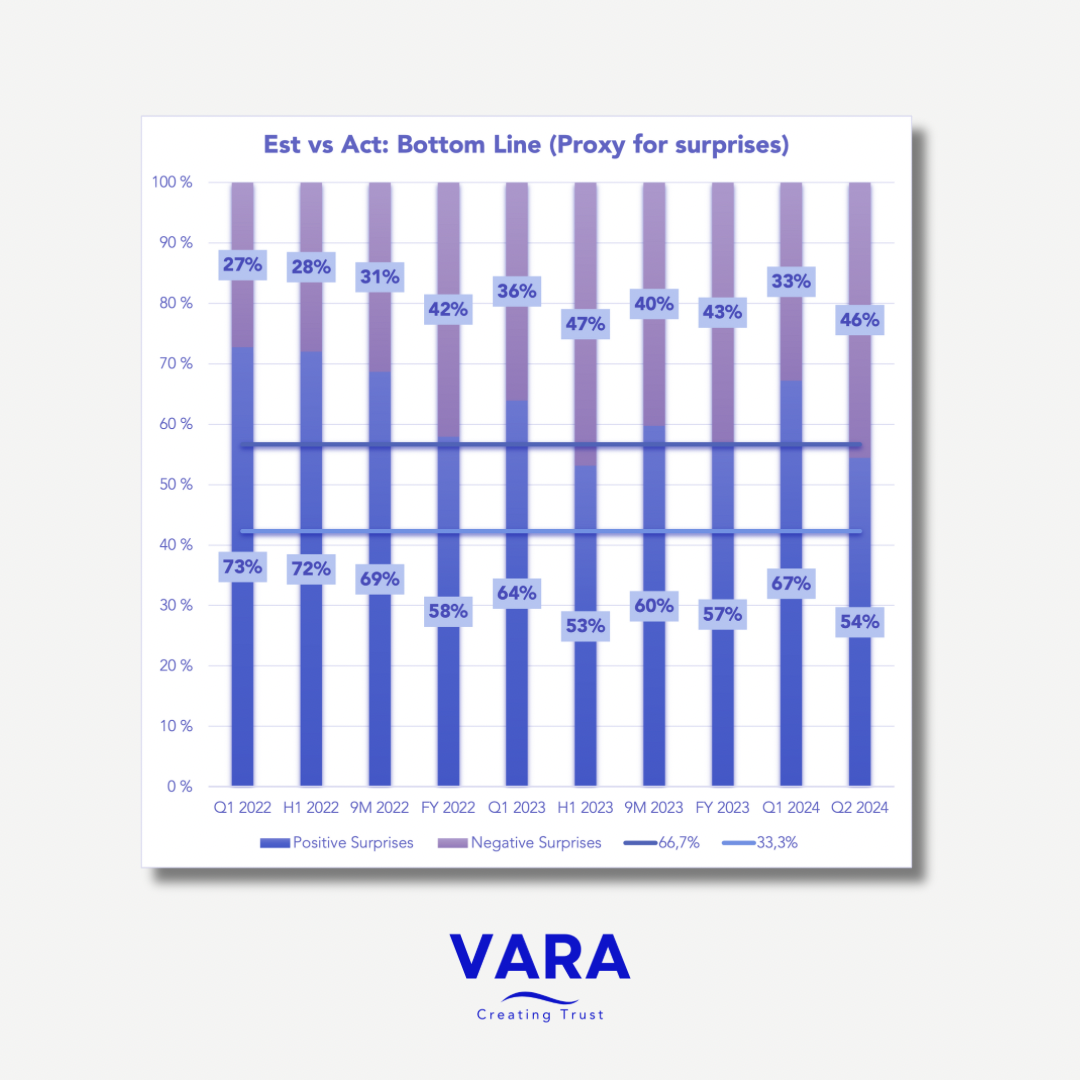

Bottom Line:

54% of companies beat the expectations, which is considerably lower than last time (67% in Q1, 2024). Looks like the margins have peaked.

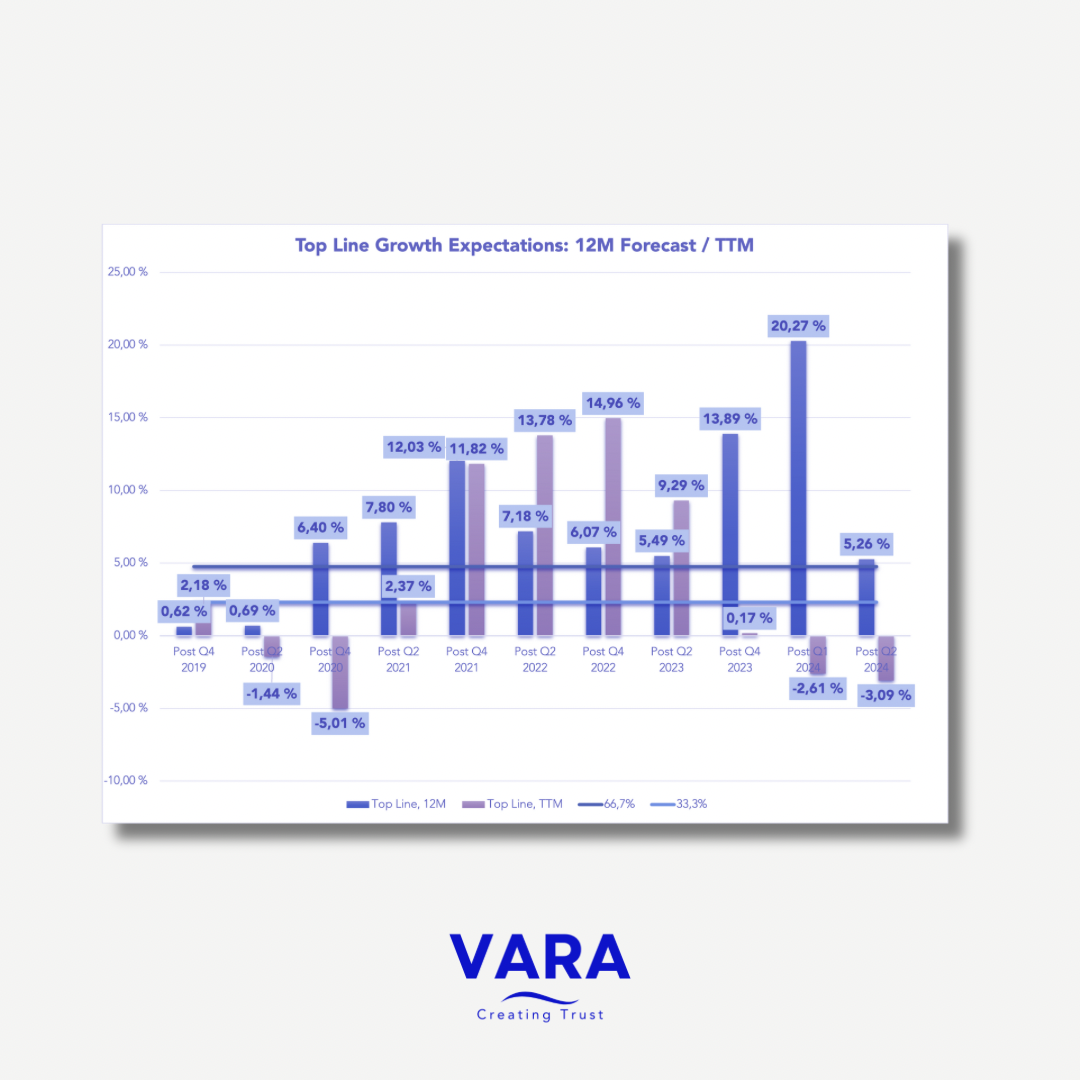

Top Line 12M Forecast / TTM:

Expectations on top line are now considerably lower (5% vs. 20% after Q1 2024). The expectations are still just in the highest thirds, but should limit disappointment potential on top line growth.

Bottom Line 12M Forecast / TTM:

Growth expectations on bottom line are as well now considerable lower (5% vs. 19% after Q1 2024).

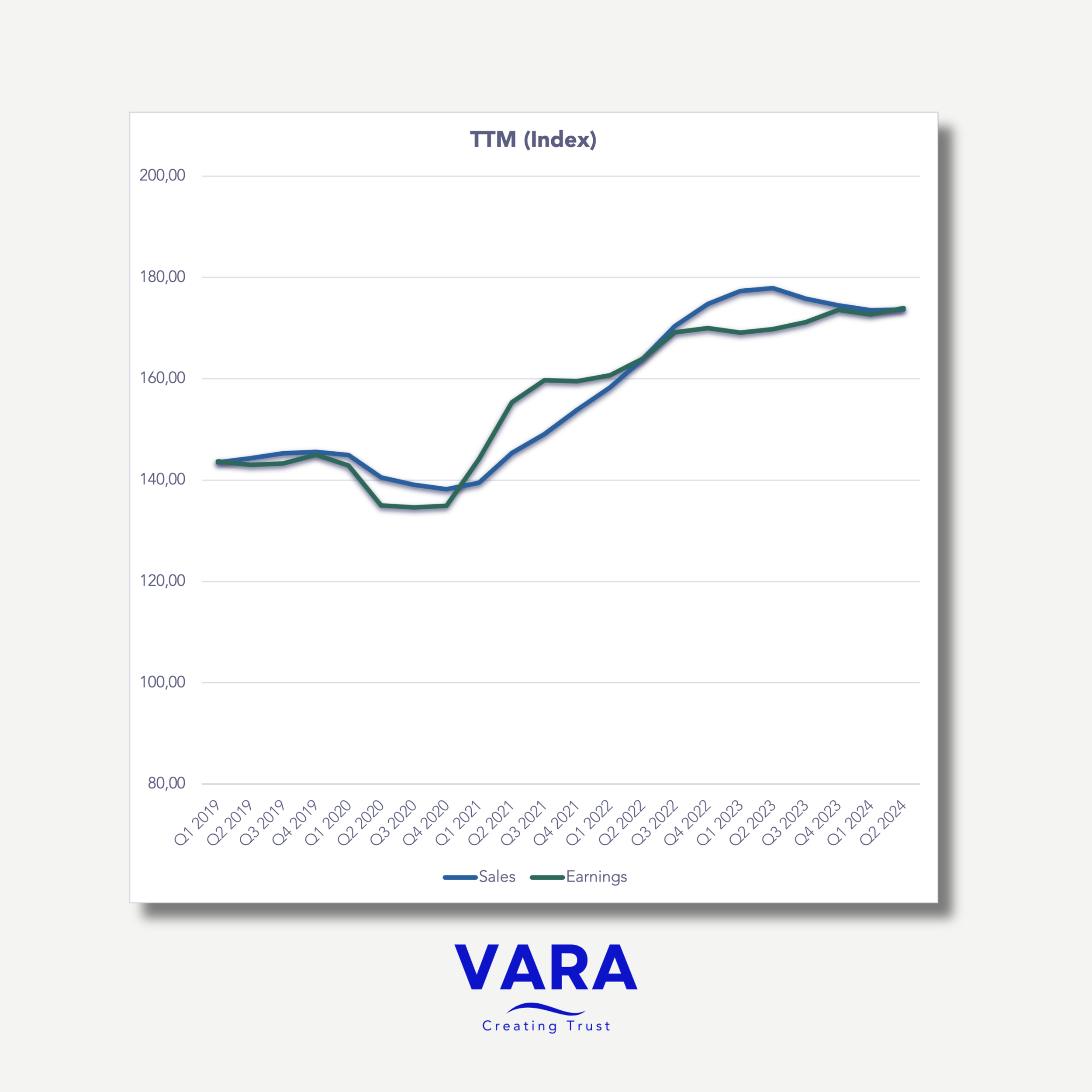

TTM (Index):

Earnings and sales growth looks to be in balance. Meaning that future earnings growth depends most likely on top line growth. Using VARA Pro investors should monitor how top line growth develops.

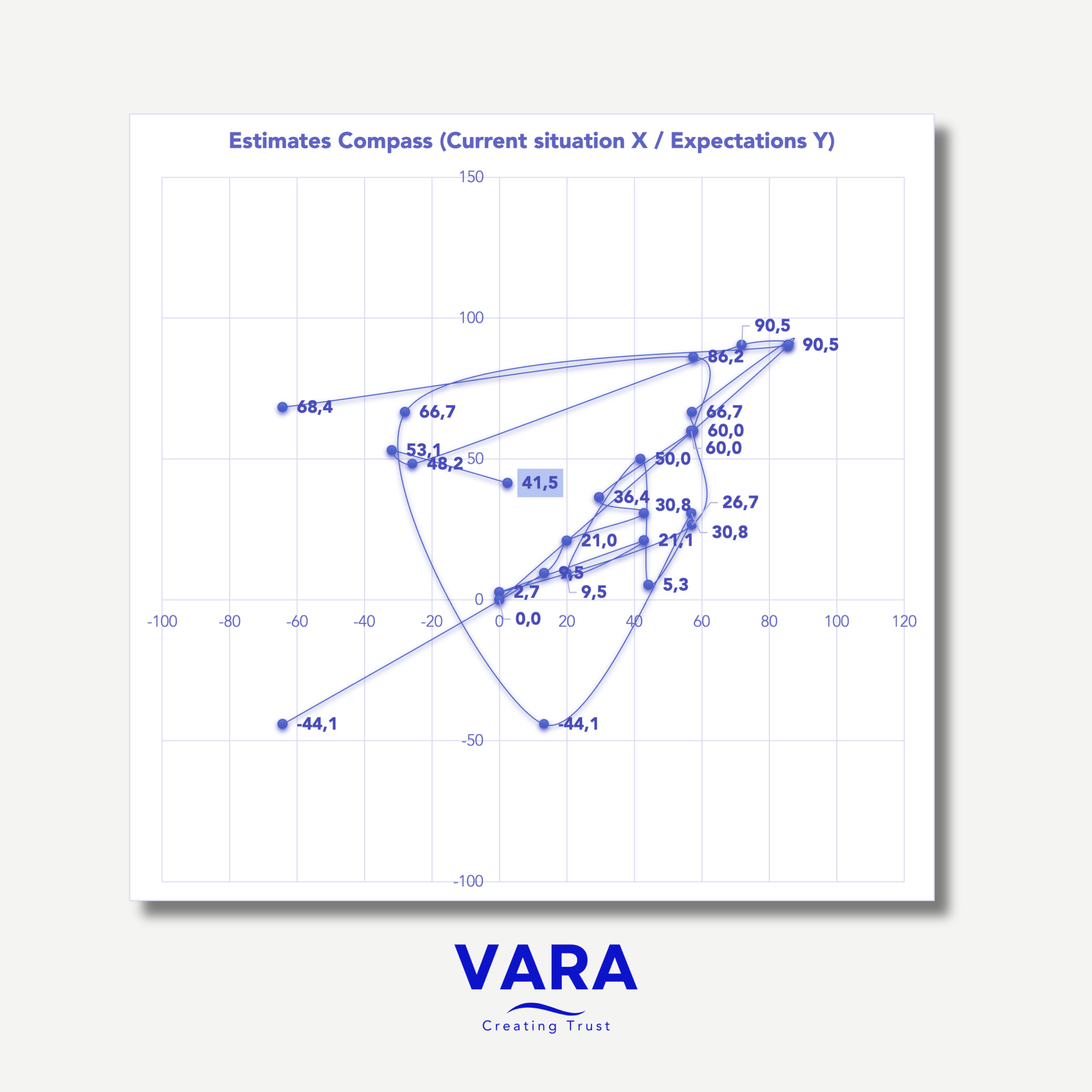

Estimates Compass:

We have now for the first time more companies with better current situation, although average growth rates for the last twelve months are negative. Bottoming out? And growth expectations are not too aggressive. Could limit massive downside potential for the stocks.